On Jan 1, 2024, a new rule was enacted by the US Department of Treasury's Financial Crimes Enforcement Network (FinCEN). It requires companies to report their Beneficial Owners (BOs) to FinCEN. With certain small exemptions, almost all startups are required to do this, and failure to do so may result in penalties.

Many founders seem to be confused and have been asking us what this means for their company. So we did a comprehensive deep dive, and thought we should open source our findings -- here's everything you'll ever need to know about FinCEN reporting.

Do I have to file?

Yes, almost all startups are required to report this information. There are small exemptions that likely won't apply to most tech startups here.

What's a beneficial owner?

A beneficial owner is any individual who either:

- Directly or indirectly exercises substantial control over the company, or

- Owns or controls at least 25% of the ownership interests of the company

What are the deadlines?

For companies created in 2024, they must submit BOI reports within 90 days of company creation.

For companies created in 2023, you have more time, and must submit by Jan 1, 2025.

What are the penalties for non-compliance?

According to Cooley, there are penalties for willful misrepresentation or willful failure to non-filing, but no penalties are specified for negligent or accidental violations.

The BOI rule does not provide for penalties for negligent or accidental violations of the law. However, any person who willfully provides, or attempts to provide, false or fraudulent BOI data to FinCEN -- or willfully fails to report, or to report complete or updated BOI data to FinCEN -- may be subject to civil or criminal penalties of up to $10,000 and up to two years in prison. A person fails to report complete or updated BOI data to FinCEN if, with respect to a reporting company, the person "causes the failure," which could include an individual's refusal to provide or submit required information for a reporting company's BOI report.

How should I file this report for my startup?

Option 1 (Recommended): Use your equity management platform to file

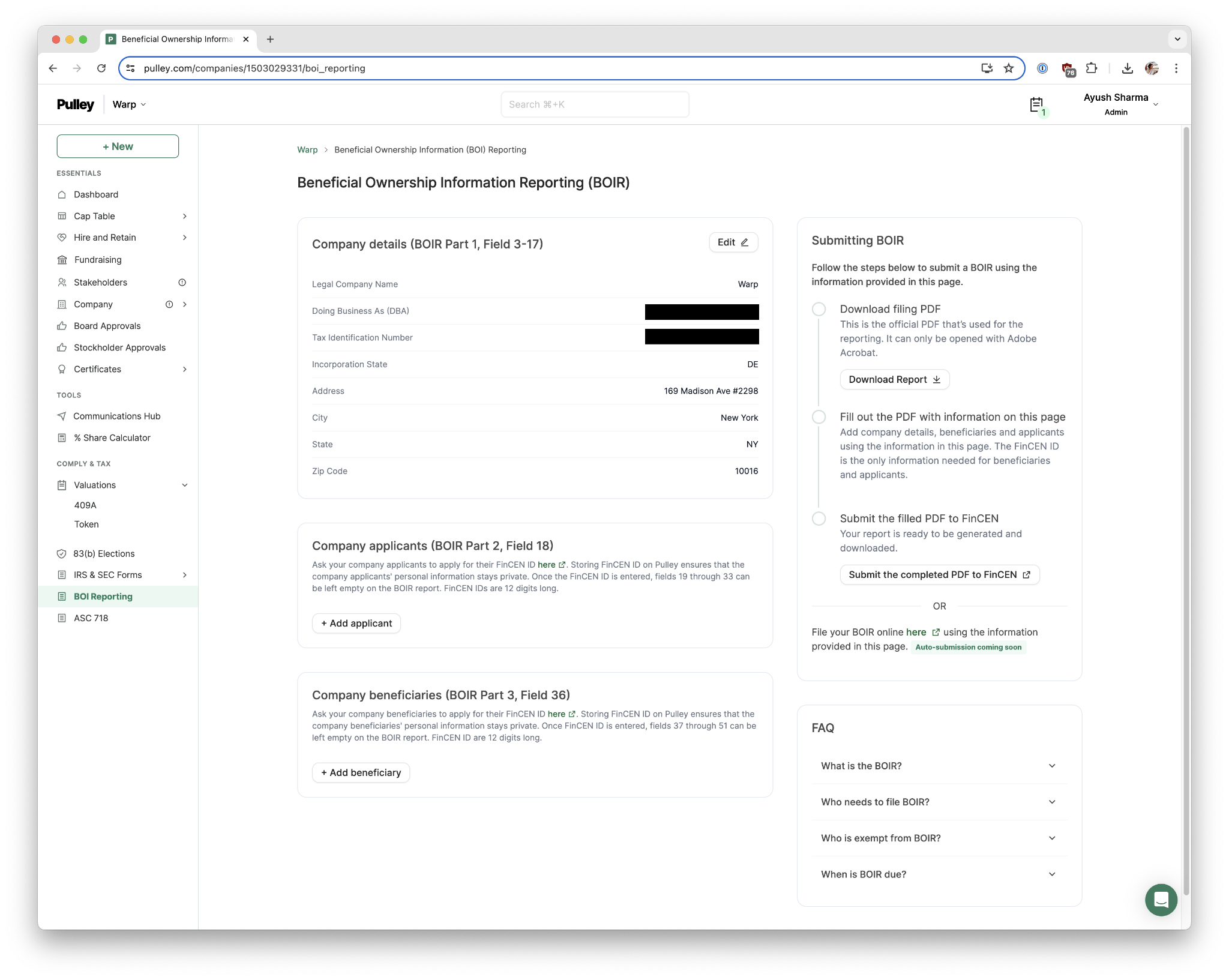

The best way to comply with BOI reporting requirements is to let your cap table platform file this for you. If you use either Clerky, Pulley, or AngelList Stack -- use them to automate this filing.

- Clerky fully automates this filing requirement, available for free on their platform.

- AngelList fully automates FinCEN filing on their platform, regardless of whether you're using them for cap table management.

- Pulley gives you an easy tool for this filing on their platform. We used it and it took us 5 mins to complete everything. Pulley will also soon have auto-submissions. Here's what it looks like on their platform if you're curious --

Option 2: File it yourself/use third party service

You can file this yourself directly on FinCEN website, or you can use a third party, including having your lawyers or tax professionals file this on your behalf.

Why use Pulley/Clerky/AngelList to auto-file BOI reports?

At Warp, we've built a platform for modern startups to handle payroll, tax compliance, and benefits. Naturally, some customers asked if we could file the BOI reports for them. We did a few filings at first. However, we now recommend using a cap table platform for this filing instead. This ensures error-free reporting that will stay up-to-date with FinCEN in the future.

The simple reason is that BOI reporting relates to Corporate Compliance. And your cap table is the source of truth when it comes to Corporate information. FinCEN requires reporting of any changes to your major company stakeholders and BOs be reported to them within 30 days. Your cap table platform always has the most current data on your corporate structure. This ensures all changes are correctly reported and propagated. If you file with FinCEN manually or use other third-party services, you might face outdated data issues later. You'd need to manually update FinCEN (or any third-party service) with your cap table details. This creates extra work and hassle for you.

Don't have a cap table platform setup yet?

I would highly recommend setting this up soon. If you're a new founder, you will need it for your fundraise, so ideally you have it all set up before you go out to raise your next round. We personally prefer and use Pulley at Warp because it's really easy to use and has great support.

The (near) future of BOI reporting

One interesting twist here is that, on March 1, 2024, a federal court declared this ruling unconstitutional. FinCEN has already appealed this decision, so the future of this ruling is a bit up in the air, but for the time being, the ruling remains effective and applicable to startups so we recommend complying with it until anything changes.

This is a new rule for founders, and the landscape is quickly evolving. As with most new rules, there's often a wave of confusion at first, then lawyers start assessing the actual impact/rate of enforcement, the amount of work needed, and eventually some platform that's part of your stack ends up automating it. See for example the 83b election filing, which Stripe ended up fully automating. We believe cap table platforms are going to play the same role here and completely automate this process for founders, making all our lives a little bit easier.

Sources

- Cooley's guide to BOI reporting

- Stripe's Primer on BOI reporting

- AngelList automates BOI reporting

- Clerky automates BOI reporting

- Pulley automates BOI reporting

(Warp isn't a law firm and can't provide legal advice. Consult legal and tax professionals for advice on how to meet ongoing legal and tax obligations for you and your company.)