Many companies, from small businesses to corporations, use professional employer organizations (PEOs) and employers of record (EORs) to run payroll. Startups that need help with payroll often turn to these solutions too — even if they don’t know what these firms do and if they actually need them.

The differences between these two types of companies can be confusing, and the lack of transparency means that startups often overpay for the services they provide. So, keep reading to find out more about each type of agency, how to know when you need one or the other, and when you should set up your own payroll instead.

Here’s what we’ll cover in this blog post:

- What is a PEO?

- What is an EOR?

- What’s the difference between a PEO and EOR?

- Five questions to ask when choosing a PEO or EOR provider

- What’s the best option for startups that need help with payroll?

What is a PEO?

A professional employer organization is a third-party HR firm that small and mid-sized businesses work with to outsource tasks like payroll, taxes, benefits management, training, and workplace risk management. Think of them as an extension of your HR team.

Say your startup is based in California, but you’d like to hire employees in New York and Florida too. The problem is, your HR department isn’t familiar with the labor laws in those states and, besides, they already have their hands full with their current workload. PEOs can cover this gap by acting as the HR department for your out-of-state teams.

When you work with a PEO, both of you enter into a co-employment partnership and share the responsibilities that come with being an employer. They take on the HR responsibilities of your company, while you maintain control over your workforce’s day-to-day tasks and duties. This frees up time for your core HR team to focus on the high-value tasks that grow your business.

Because PEOs work with multiple companies at a time, they’re also able to offer their clients lower rates on insurance policies and employee benefits. Overall, companies that work with PEOs save about 27.2% in HR-related costs each year.

What is an EOR?

In comparison, an employer of record acts as the legal employer in areas where you don’t have a legal entity (meaning they’re in charge of the employment paperwork), while your company remains the employer of your workforce functionally.

EORs already have the infrastructure needed to hire international employees — including the legal entities, bank accounts, payroll systems, and insurance coverage required by local governments — so growing startups can simply “lease” theirs as they expand their own organizations.

And because EORs already have legal entities in the countries you plan on operating in, you can expand your international team as quickly as you need to without being tied down by business registration requirements and other regulations.

Although employers of record often help with HR functions and other administrative work, they specialize in the legal aspect of global employment — think employment contracts, payroll, benefits administration, and compliance. Client companies can conduct business as usual knowing that their EOR provider has their international workforce covered.

What’s the difference between a PEO and EOR?

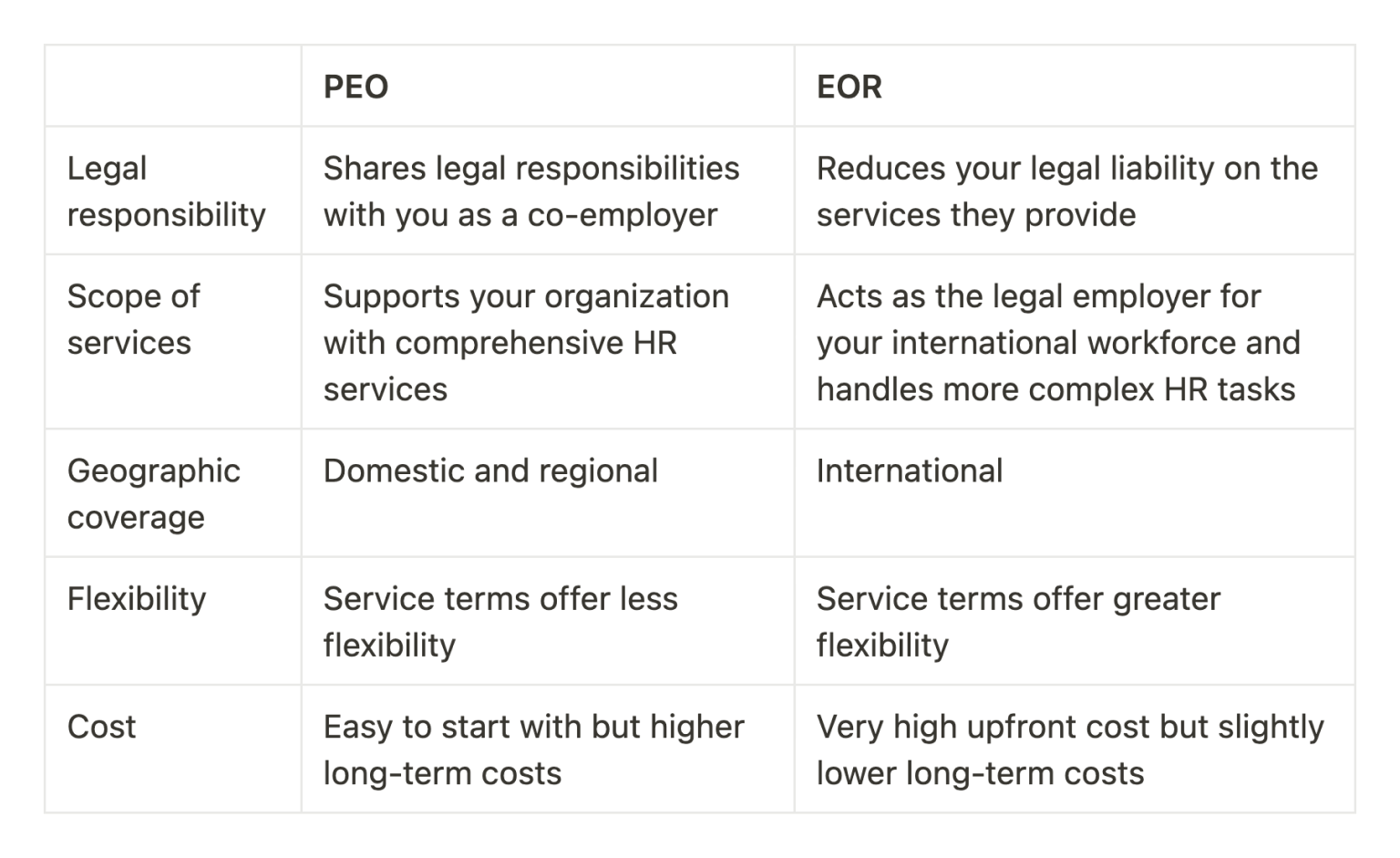

PEOs and EORs share a lot of overlap in the services they provide and the role they play for client companies, so it’s easy to get them confused. Here are some of the biggest differences between these two types of companies.

Legal responsibility

As mentioned earlier, professional employer organizations act as your co-employer, so you both share responsibility for your employees. They handle HR tasks on your behalf, but if they make a mistake while conducting their services, you’re also responsible for the consequences.

As the registered employer of your international workers, an employer of record takes on the legal duties that come with being an employer. Any liability or risk that results from the services the EOR provides falls on the provider’s shoulders rather than the client company’s.

However, EORs and PEOs won’t run your company for you. You’re still responsible for choosing which employees to hire, setting wages, and making other business decisions that drive your organization forward.

Scope of services

PEOs provide support for your company’s HR-related tasks and duties.

Although most of them offer services like payroll and benefits management, recruitment, and tax compliance, some have specialized offerings like onboarding, training, employee handbook creation, and workforce analytics. However, they don’t have the legal know-how that EORs offer, so you’re solely responsible for staying up-to-date and complying with local labor laws.

Because EORs act as the employer of your international workers, their biggest strength lies in their vast expertise on the countries they operate in.

This knowledge covers everything from employee benefits administration and payroll compliance to employment contracts, visas and work permits, and regional employment expectations. Some agencies will offer HR support, but they typically don’t have a wide range of these services like PEOs do.

Geographic coverage

PEOs specialize in domestic and regional expansion. Combine this with the fact that you need to set up legal entities yourself, and you’ll find PEOs aren’t ideal for startups that want to hire in multiple countries at once. Instead, they’re best for companies that want support in expanding their operations to the local geography or within their home country.

EORs, on the other hand, are ideal for hiring workers across multiple countries. Thanks to their comprehensive legal services and knowledge of international labor law, these firms are a great resource for startups seeking global expansion with minimal effort.

Flexibility

Because professional employer organizations require you to establish legal entities yourself, you’ll need to spend time and money registering your business in your target countries. This gives you less flexibility in how many regions you can expand to and how soon you can do it.

Many PEOs also have employee minimums in their contracts, which means that client companies will need to plan and budget accordingly for growth through this type of agency.

Since employers of record “lease” out their infrastructure to their client companies, startups can expand their organizations into whatever countries their provider operates in. And because EORs are much less likely to enforce minimum headcounts, even the smallest startups are able to work with them.

Cost

EORs and PEOs charge client companies in one of two ways: a flat fee per employee per month or a percentage of the company’s total payroll. You may also be responsible for other fees, such as setup fees, transaction fees, and termination fees.

However, EORs typically charge more than their PEO counterparts to take into account their comprehensive legal knowledge and complex responsibilities. These higher fees also offset the cost of managing their infrastructure and legal entities.

Five questions to ask when choosing a PEO or EOR provider

If you plan on partnering with a PEO or EOR to manage your workforce, here are a few questions to answer before you make your decision.

What are your company’s needs and goals?

Do you just need a few extra hands to help with your HR work? Or are you looking to hand off all employment responsibilities for your workforce? Are there industry requirements or expectations that your chosen provider must meet?

Many tech startups include stock options as part of their employee compensation plans to keep their job offers competitive. So if this is something you’d like to offer to new hires, you may seek out providers that manage this benefit for you.

Make sure to consider both your immediate plans and your long-term goals as well. A little bit of foresight and planning can help you avoid unnecessary switching between providers later on.

Let’s say you want to expand your US-based company to Canada and Mexico this year, but you also have plans for new offices in Europe down the line. Ideally, you want to make sure the provider you choose offers their services in all of these regions.

What are your company’s needs and goals?

Whether you need a legal entity in your target region or country will also depend on your needs and goals. Since registering a business in a new country takes considerable time and resources, startups that undergo this process typically only do so if they want a permanent presence there.

If you only expect to hire a few workers, or if you’re still testing the waters in a new market, you might be drawn to the flexibility offered by an employer of record. Startups with long-term plans, meanwhile, may establish their overseas business presence themselves then offload their HR tasks to a PEO.

What kind of workers will you hire?

The type of provider you choose for your startup will also depend on the kind of workers you plan on hiring. Since most PEOs only offer their services within the US, you’d seek them out to set up operations in multiple states. EORs, with their international focus, are best engaged for global expansion.

Also consider whether you plan on hiring employees, independent contractors, or a mix of both.

Independent contractors are well known for the versatility they offer startups, but these arrangements may be less practical when you partner with a professional employer organization. Data from Statista shows that contract workers tend to stay with companies for about 10 weeks on average. If your startup has independent contractors joining and leaving teams frequently, you may have difficulties meeting the minimum headcount needed to hire a PEO in your target country.

Since their contracts offer less flexibility than those of their EOR counterparts, PEOs are often best suited for companies with full-time staff.

On the other hand, startups that work with a significant number of freelancers and temporary workers may find more benefits in an employer of record. Because EORs are generally more well-versed in the labor and employment laws of the countries they operate in, they can help you stay compliant with those countries’ worker classification guidelines — and avoid costly fines, penalties, and lawsuits in the process.

How many workers will you hire?

The service terms and offerings of PEOs and EORs mean they each cater to organizations of different sizes as well.

PEOs are more likely to have employee minimums that client companies must meet, so this option may be better for growing businesses that have the funds to invest in bigger teams.

Meanwhile, EORs are the opposite. You can be more flexible in your plans and how you want to expand your organization with this type of agency, since many providers don’t have minimum headcounts for their clients. This makes EORs ideal for startups working with limited funds or planning for expansive growth.

Have you done your due diligence?

As with all decisions you make regarding your business, you’ll also want to do your due diligence before signing a contract with any provider.

Some agencies hand off the work to a separate third party instead of performing the services themselves. Their clients pay a markup on the services, often in exchange for an unsatisfactory employee experience and inconsistent support. Avoid this by asking whether the provider actually owns the entities and processes they manage, and what infrastructure they have in place to support your company.

Other actions you’ll want to take include:

- Confirming each provider’s service coverage and expertise in the regions or countries you want to expand into

- Asking what they do to keep their processes compliant and their information up-to-date

- Reading reviews, testimonials, and case studies to ensure they can provide the level of service you’re looking for

What’s the best option for startups that need help with payroll?

Professional employer organizations are a great choice for companies that don’t have the people or expertise to oversee the HR work for that region.

In comparison, employers of record are ideal for businesses and startups that want to have international employees. In many cases, EORs are the only way for companies to meet foreign regulations without straining their operations.

If you want to keep control over payroll, and if your workforce is primarily based in the US, managing payroll with Warp is a way better option than either PEO services or EORs.

Before Warp, startups faced a dilemma when it came to managing payroll and compliance. They could either handle these tasks in-house, which often proved to be time-consuming and complex, or opt for a PEO solution. With the introduction of Warp, startups now have access to a new option that combines the best aspects of both approaches. Warp allows startups to streamline their payroll and compliance processes without breaking the bank or sacrificing quality.

Compared to EORs and PEOs, startups can save much more with Warp. PEO services typically cost anywhere between 2% and 12% of a company’s payroll, while EOR services can range from $199 to upwards of $650 per employee per month. In comparison, payroll management with Warp only costs $20 per employee per month.

Take care of your global workforce with payroll software that helps you manage your full-time staff and freelancers all in one place. Not only is this option more cost-effective for startups with lean budgets, running payroll with Warp simplifies compliance and gives you more control over your hiring process.

Learn how Warp can simplify your payroll operations by requesting a demo today.